IRS 4972 2024-2025 free printable template

Instructions and Help about IRS 4972

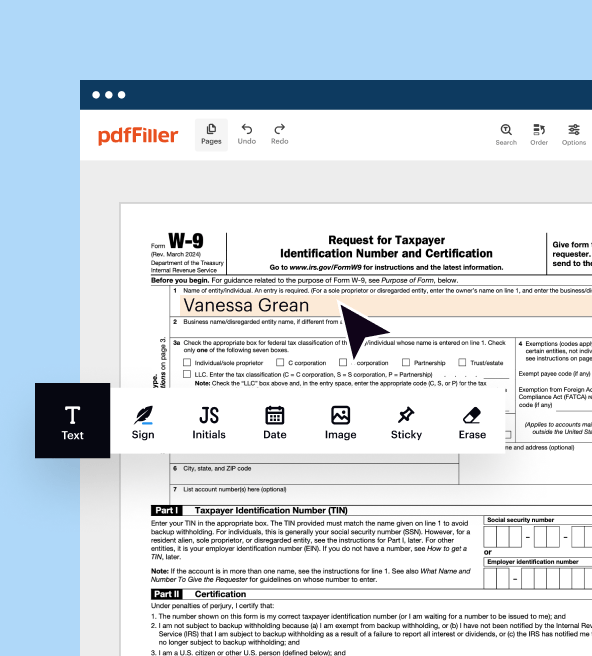

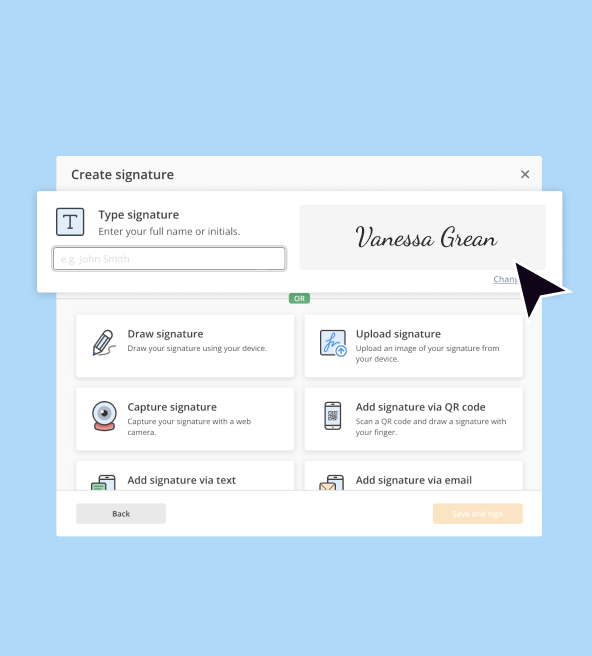

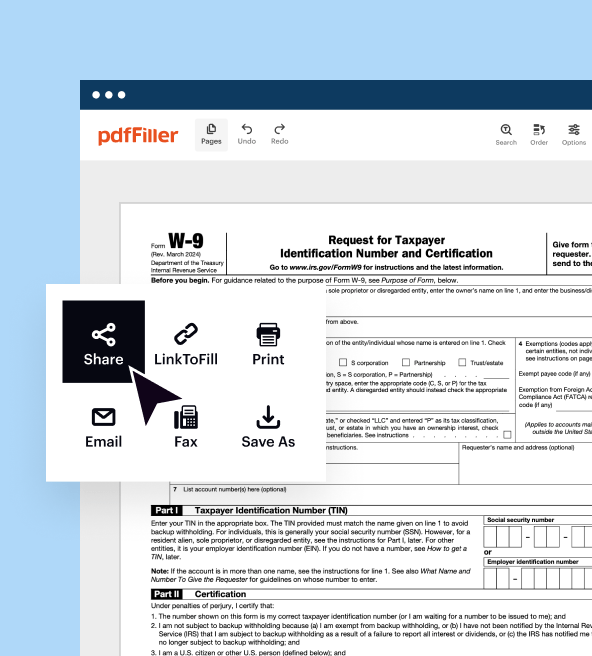

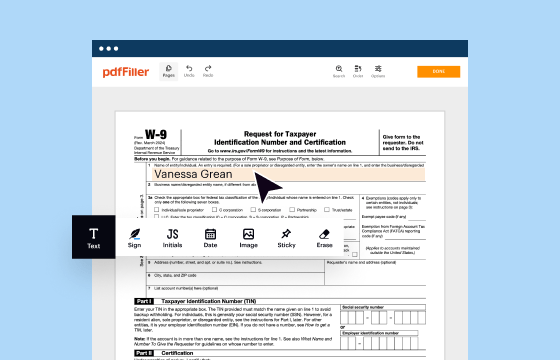

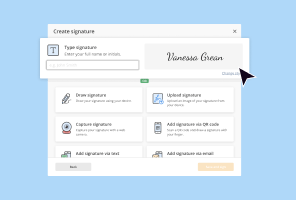

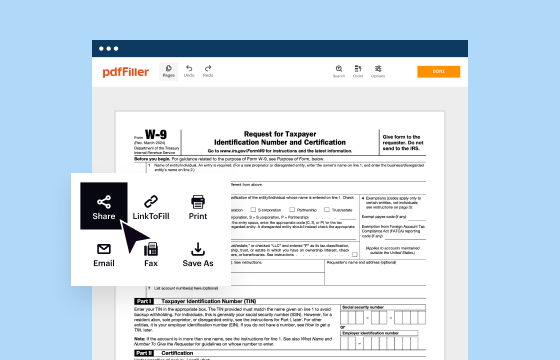

How to edit IRS 4972

How to fill out IRS 4972

Latest updates to IRS 4972

All You Need to Know About IRS 4972

What is IRS 4972?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4972

What should I do if I discover an error after submitting IRS 4972?

If you find an error after filing IRS 4972, you should file an amended return using the appropriate form. It's essential to submit this correction as soon as possible to avoid potential penalties. Ensure you check for the correct IRS form and follow the guidelines for amending your submission.

How can I verify if my IRS 4972 was received and processed?

To check the status of your IRS 4972, you can use the IRS 'Where's My Refund?' tool online if applicable, or contact the IRS directly. Keep in mind that processing times can vary, so allow adequate time before checking, typically around 21 days for e-filed returns.

What are the common mistakes filers make with IRS 4972 and how can I prevent them?

Common mistakes include incorrect Social Security numbers, improper calculations, or failing to sign the form. To prevent these issues when filing IRS 4972, double-check all entries, preferably with tax preparation software, and ensure that you follow all guidelines outlined by the IRS for accuracy.

Are there special considerations for non-residents filing IRS 4972?

Yes, non-residents filing IRS 4972 need to be aware of specific requirements related to their residency status and the type of income being reported. It's important to understand the implications of tax treaties and whether any special instructions apply to your situation.

See what our users say